• We accept checks, cash, and/or money orders in person.

• Credit card payments can be made by phone at (910) 363-1002 or online here. Please note a 2.50% convenience fee will apply.

UPCOMING MEETINGS

- We accept checks, cash, and/or money orders in person.

- Credit card payments can be made by phone at (910) 363-1002 or online here.

- Credit Card Covenience Fee: 2.5% of total

- Retuned Check Fee: $35.00

- Recycling/Yard Debris Collection: $12.75/month

- Recycling/Yard Debris will be billed and collected by Brunswick County.

BEWARE of 3rd party pop-up credit card vendors. Our credit card vendor has the City seal on it.

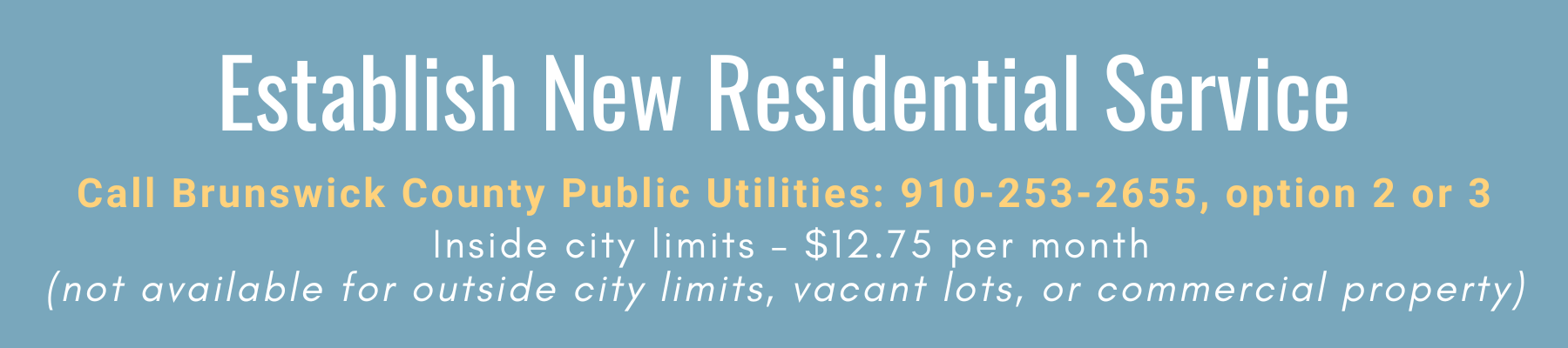

Establish, Transfer, or Discontinue Utility Service

To establish water, sewer, and/or irrigation service at a residence that already has a service connection, the requestor should contact Brunswick County Public Utilities: (910) 253-2655, option 2 or 3.

Establishing a New Electric Service

- Time of Application: The City will strive to meet customers’ needs for connection of service. Normal connection will be made the same day as the request if submitted by 1:00 p.m. (This is if service has been disconnected prior to application)

- Prior Debts: The City of Southport may not provide utility service to an applicant who is indebted to the City for service previously furnished until all indebtedness has been satisfied.

- Residential Deposits: Residential customers may be required to pay a deposit to begin utility service. Deposits are based on information obtained from credit reports through Experian. See fee schedule.

- Commercial Deposits: Commercial account deposits are reviewed on a case-by-case basis and are generally 2 times the average bill amount or 2 times the base amount, whichever is greater.

- Renter Deposits: Renters will be required to pay a deposit to begin utility service. Deposit amount is based on information obtained from credit reports through Experian. See fee schedule.

- Good Credit History: Is defined as no late payments, delinquent charges, extension, bad checks or involuntary disconnections for 2 years.

- Future Deposits: Any customer whose service is involuntarily terminated for either non- payment, meter tampering, or other reasons may be required to pay an additional cash deposit prior to reconnecting service.

Commercial Properties

*Will be required to pay a deposit in place of having credit pulled. (See commercial deposits)

Discontinuation of Service

Any customer requesting discontinuation of service shall do so with the following contacts:

- Water/Sewer/Irrigation: Brunswick County Public Utilities, (910) 253-2655, option 2 or 3

- Electric: Brunswick Electric Membership Corporation, (910) 457-9808

General Utility Information

Utility Service and Billing Information

The City’s Response to Returned Checks

- The city will accept only cash, certified checks, or money order from any customer having 2 insufficient funds (bad) checks within any 1 year period.

- Upon receipt of the 2nd returned check, the customer will be advised that ALL bills must be paid in cash, certified check, or money order for the next year.

- After the 1 year period ends, if another insufficient funds check is received all future bills must be paid in cash.

- As allowed by the State of North Carolina, a $35 charge is added to the customer’s bill for each returned check. (See Utility Fees & Deposits)

Fees and Deposits

General Fees Effective July 2023

| Returned Check | $35.00 |

|

After Hours Water Connection or Service Fee after 3:30pm

|

$50.00 |

| Credit Card Convenience Fee (effective August 2023) | 2.50% |

Average Deposits Effective July 2023 (inside City limits)

*NOTE: Deposit required for all renters.

| Residential – Electric |

$375.00

|

| Commercial – Electric | $500.00 |

Commercial account deposits are reviewed on a case-by-case basis and are generally 2 times the average bill amount or 2 times the base amount, whichever is greater.

For residential accounts opened in a business name, the required deposit will be 2 times the monthly base rate or 2 times the average monthly bill, whichever is greater.

Resources for Assistance

Resources for Assistance

Difficulty in Paying Bill: The following organizations may be able to offer assistance to customers who are having difficulty paying their bills.

Brunswick Family Assistance Agency

929 Old Ocean Hwy

Bolivia, NC 28422

(910) 754-4766

First Wednesday from 9:30 – 11:30 a.m. @ Trinity United Methodist Church of Southport

Social Services

Brunswick County Government Complex, Bolivia, NC 28422

Southport Number: (910) 457-6227

Bolivia Number: (910) 253-2077

Local Community Churches

The City of Southport encourages each customer to seek assistance with paying their utility bill prior to disconnection of service.

Neighbors4Neighbors

June 18, 2024

Dear Customer,

The merger of the City of Southport’s Water and Sewer System into Brunswick County Public Utilities is complete, and you are now a customer of Brunswick County Public Utilities. All future bills for water, sewer and recycle/yard debris will be issued by Brunswick County Public Utilities.

The Neighbor 4 Neighbors program was developed by the Southport Board of Aldermen in 2019 to assist City residents that were struggling to pay the increasing sewer bills, and since that time qualifying residents have received a $40 per month reduction to their sewer bills. Now that Brunswick County has assumed ownership, Southport no longer operates a water or sewer system and as a result Southport’s Neighbors 4 Neighbors program has ended. The credit that was applied to the bill dated May 26, 2024 will be the final assistance applied to your account.

In February 2024, Southport reduced its billing rates to be similar to Brunswick County rates and as a result sewer charges are now back to the levels that existed before the Neighbors 4 Neighbors program began. If you need assistance with your utility bill in the future, Brunswick Family Assistance is still available to assist with bills issued by Brunswick County Public Utilities. They are located at 929 Old Ocean Highway, Bolivia NC 28422 and their phone number is 910-754-4766.

For questions about your Brunswick County service, billing, or payment options please visit the website below or reach out to Brunswick County Utility Billing anytime during their regular business hours Monday through Friday from 7:30 a.m. to 5 p.m.

- https://brunswickcountync.gov/642/Ways-to-Pay-Water-Sewer-Bill

- Phone: 910.253.2655 (Select Option 2 or 3) or 888.428.4426

- Email: utilitybilling@brunswickcountync.gov

On behalf of the City of Southport, we thank you for being our customer for so many years and wish you the best moving forward in your new relationship with Brunswick County Public Utilities. We have enjoyed serving you and look forward to working with you through this transition period.

Sincerely,

The City of Southport Utilities Team

Brunswick County Public Utilities

New Services, Billing and Rates

Tel: (910) 253-2655, option 2 or 3

Email

City of Southport Public Services Director

Tom Stanley | Tel: (910) 457-7935

Email

City of Southport Public Services Administrative Assistant

Jackie Smith | Tel: (910) 457-7935

Email

Water-Sewer Merger FAQs

Q: How was the City able to reduce rates so much?

A: Southport has been facing significant capital improvement needs in the water and sewer system, including the need to pay for expansion of the County’s wastewater treatment plant (the City doesn’t have one of its own), and replacing old and failing sewer pipes. In recent years the City’s higher rates for water and sewer utilities have allowed it to begin saving for these large expenditures so the citizens would not have to pay for everything at once. In the last State budget, the General Assembly allocated funds to Brunswick County to help pay for these improvements so that the City could merge its utilities with the County. This appropriation means that Southport no longer has to save for these large capital expenditures, so in anticipation of the merger, the Board of Aldermen reduced the billing rates to be as close as possible to the amounts that would be billed by Brunswick County at their current rates.

Q: Why were previous rates so high?

A: Southport has been facing significant capital improvement needs in the water and sewer system, including the need to pay for expansion of the County’s wastewater treatment plant (the City doesn’t have one of its own), and replacing old and failing sewer pipes. In recent years the City’s maintained higher rates for water and sewer utilities in order to begin saving for these large expenditures so the citizens would not have to pay for everything at once.

Q: Will I get a refund for past payments?

A: No. Your rates have been reduced going forward, but there is no equitable way to calculate refunds since over the years new accounts have opened, old accounts have closed, and a variety of customers have paid utility bills for varying lengths of time. All cash that remains in the Water-Sewer fund at the time of the merger will be transferred to Brunswick County to be applied to the capital improvements for which the money was collected.

Q: Are the new rates the same as the County will charge?

A: The new rates are close to, but not exactly the same as, the rates the County will charge. The County and the City use different billing systems with different structures for calculating utility charges. The City has adjusted the rates in its structure to get as close as possible to the County rate structure, but there are likely to be small variances when the County assumes billing. Brunswick County billing rates can be found on its website at https://www.brunswickcountync.gov/645/Water-Sewer-Rates

Q: Why am I still being billed by Southport and not Brunswick County?

A: Although the Southport Board of Aldermen has voted to merge the water and sewer systems into Brunswick County’s systems, and the City and the County are actively working towards a merger, the merger is not yet complete. This merger involves many complicated details to be finalized, and until the merger is complete, you will continue to receive utilities from and be billed by Southport. However, in anticipation of the merger being completed, the Southport Board of Aldermen have reduced utility rates immediately to a level that is approximately the same level that Brunswick County would be charging.

Q: When will the merger be complete?

A: This merger involves many complicated details to be finalized, but completion of the merger is expected to become final in 2024. Until the merger is complete, Southport customers will be charged the reduced rates that are designed to be as close to the County rates as possible within our current billing system.

Q: After the merger, will I still be able to pay my Utility Bill at City Hall?

A: No. After the merger, Southport will no longer own the utilities and will no longer accept payments either at City Hall or by dropbox. After the merger you must pay your bill through the methods provided by Brunswick County, which include by mail, by direct debit to your bank account, online or by phone using a debit or credit card, or in-person at the County facilities located at 3769 Old Ocean Highway, Bolivia, NC 28422. Details of payment options can be found on the County’s website at https://www.brunswickcountync.gov/642/Ways-to-Pay-Water-Sewer-Bill

Q: After the merger, who do I contact with billing questions?

A: Brunswick County Public Utilities. Their phone number is: 910-253-2655, option 2, from Monday through Friday 8:30 am to 5:00 pm. You can also email them at utilitybilling@brunswickcountync.gov, and their website is https://www.brunswickcountync.gov/607/Utility-Billing

Q: After the merger, who do I contact if I have a problem with my water or sewer service?

A: Brunswick County Public Utilities. Their phone numbers are: 910-253-2657, option 1, from Monday through Friday 8 am to 4:30 pm. For after-hours emergencies call one of the following numbers: 910-755-7921, 910-371-3490, or 910-454-0512. You can also email them at utilityadmin@brunswickcountync.gov, and their website is https://www.brunswickcountync.gov/510/Public-Utilities.

Wastewater Collection & Treatment Solutions

Payments must be received by the 15th of each month and can be made in person at City Hall, in the blue drop box in front of City Hall, or by mailing a check to:

City Hall

Attn: Tax Collector

1029 N Howe St

Southport, NC 28461

Occupancy Tax

The City of Southport levies an occupancy tax on all rentals of hotel/motel rooms, homes, cottages, or other lodging facilities that are rented to the same person for less than 90 continuous days. This tax on accommodations is currently levied at 3% of gross receipts.

Tax reports and accompanying tax payments must be filed with the City monthly by the 15th day of the month following the reporting month. This means that the tax report for rental monies collected from January 1-January 31 is due to the City by February 15. This is the case throughout the year.

A Room Occupancy Tax Report declaring the gross receipts should be submitted to the City for all rented units each month, even if there was no rental income for that period.

Please use the below form to submit your monthly occupancy tax.

Occupancy Tax Form

Electric Service Administration

Finance Department

New Services, Billing and Rates

Tel: (910) 457-7900

Energy Manager

Larry Ditton | Tel: (910) 457-7938

Email

Department Administrative Assistant

Jackie Smith | Tel: (910) 457-7935

Email

Electric Service Rates

Rates Effective July 2023

Residential:

Base Rate: $23.00/month

Rate Code: $/kWh

SR0: $0.127

SR1: $0.117

SR2: $0.107

SR3: $0.097

SR4: $0.087

Commercial:

Base Rate: $25.50/month

Rate Code: $/kWh

SC0: $0.127

SC1: $0.117

SC2: $0.107

SC3: $0.097

SC4: $0.087

Commercial Demand:

Base Rate: $75.00/month

Usage: $0.05710/kWh

CP Demand: $32.72/kW

Excess: $2.50/kW (NCP-CP)

Large Commercial Demand:

Base Rate: $75.00/month

Usage: $0.05980/kWh

CP Demand: $26.00/kW

Excess: $4.00/kW (NCP-CP)

Rooftop Solar Rates

BUY ALL/SELL ALL

Base Rate: $23.00/month + $3.75

Rate Code: $/kWh

SP15: $0.0665

NET METERED

Base Rate: $28.00/month

Rate Code: $/kWh

SP30: $0.125*

*Load Management Program is applicable

On this page: Household Garbage | Yard Debris | Safety Tips | Brunswick County Waste Convenience Centers

Household Garbage

serviced every Tuesday

For questions about pickup: GFL Environmental

GFL Environmental will only pick up household garbage if it is in the proper container (95-gallon roll-out cart). Please do not mix household garbage with recycling and/or yard waste; do not mix one waste with any other waste. Please have a container to curb by 6 a.m.

For new residents and/or replacement carts, contact Brunswick County Solid Waste at 910-253-2520.

The cart roll-out for handicapped persons will be provided upon request and completion of the required paperwork.

Holiday Trash Service

Unless otherwise noted, service that falls on the holidays listed below will be completed the following day, and service for subsequent days in the same week will also be completed one day later. In the event that a holiday falls on a regularly closed business day, service for that week will continue as normal.

- New Year’s Day | Office: CLOSED, Collection: OPEN

- Good Friday | Office: CLOSED, Collection: OPEN

- Memorial Day | Office: CLOSED, Collection: OPEN

- Independence Day | Office: CLOSED, Collection: OPEN

- Labor Day | Office: CLOSED, Collection: OPEN

- Thanksgiving | Office: CLOSED, Collection: CLOSED. Thursday’s route will be rescheduled to that Saturday.

- Christmas | Office: CLOSED, Collection: CLOSED. The collection schedule will be adjusted and announced in advance by GFL Environmental.

Yard Debris

serviced every Wednesday

Brush Bandits will only pick up the following yard waste per residence (any reasonable combination is acceptable):

- 2 approved* resident-owned and maintained 95-gallon roll-out carts OR

- Up to 15 biodegradable paper bags (no plastic bags of any type accepted) OR

- Up to 4 securely tied bundles (max 5’ long & 50 pounds in weight).

Note: Yard debris carts are not provided by the city. However, 95-gallon roll-out carts can be purchased from the third-party vendor of your choice.

*Approved containers can be: tote with NO logo, tote with Brush Bandit logo, or Brush Bandit tote.

Yard Waste will not be serviced if:

- Trash or recycle carts are used.

- Trash or recycling is mixed in with yard waste in an approved yard waste cart.

- Cart and/or bag is filled with dirt/sand.

- No vacant lots will be serviced.

Per the contract with the contractor, all rollout carts are the property of the homeowner. The City of Southport and Brush Bandits are not responsible for the maintenance or repair of said carts.

Yard Debris Removal Guidelines

Safety Tips

BAG ALL LANDFILL TRASH: By bagging your trash, especially items like used tissues, it is easier to keep viruses and bacteria away from our critical service employees.

COMPLETELY EXTINGUISH GRILLING COALS: If hot ashes are dumped into the trash truck, a fire will start.

EMPTY ALL LIQUIDS: Liquids can carry viruses and bacteria, and can splash onto drivers when trash and recyclables are emptied. When bottles, cans, and other containers are emptied before going in carts, the risk is minimized.

KEEP ALL RECYCLING CLEAN AND LOOSE: When recycling is loose, it is easier to handle on our sorting line. Removing food and liquid residue from your recyclables minimizes viruses and bacteria as well!

WIPE/DISINFECT CART HANDLES AND LIDS: The two main touch points on a cart for our drivers are the lid and the handles. By wiping those areas down with disinfectant or soapy water, you minimize the danger of shared contact areas.

SEAL AND MARK ALL SHARPS/NEEDLES: Properly dispose of medical sharp objects such as syringes by placing them in a sealed, rigid plastic container. Seal the container in duct tape, clearly mark it as “Sharps,” and place it in the trash.

Brunswick County Waste Convenience Centers

Brunswick County Convenience Centers accept residential solid waste from Brunswick County only.

Some rates are given based on a standard-sized pickup truck. Trucks larger than a standard pickup truck must dispose of waste at the Bolivia Landfill and are subject to landfill tipping fees.

For accurate pricing, please separate materials when loading your vehicle.

When transporting items in a pick-up truck or trailer, be sure to do so safely! Properly secure items in the truck bed, cover loose material that could fly out and use a red flag on items that extend beyond the truck bed.

Location and Hours

Open 8 a.m. to 6 p.m., Monday, Wednesday, Friday, and Saturday.

- 746 Seaside Road SW, Sunset Beach

- (910) 579-9932

- 9921 Chappell Loop Road SE, Leland

- (910) 371-9471

- 1709 Oxpen Road SW, Supply

- (910) 842-9523

- 8392 River Road SE, Southport

- (910) 457-9484

Book Swap Program

Brunswick County Solid Waste & Recycling has a book swap building located at each Convenience Center. The building is open to all Brunswick County property owners and residents. You may bring old books and magazines to the building and leave them for others to take, and you may take books or magazines for your personal use.

This program is a free program. You do not have to bring a book or magazine to take one.

Questions concerning the program may be directed to the Brunswick County Solid Waste and Recycling Department at 910-253-2520 or email them here.

Recycling Bins

The City provides a blue recycling cart that is picked up bi-weekly. We are encouraging all residents who have not participated in this program to please do so and to take personal responsibility in doing their part to recycle. If you do not have a cart, please call (910) 457-7900, option 1.

Brunswick County Waste Convenience Centers will accept recyclables at no charge. For additional information and details, please visit: https://www.brunswickcountync.gov/solid-waste-and-recycling/recycling/

Recycling Schedule

every other Tuesday

Recycling is every two weeks for each residence.

- Schedule “A” will be on the West side of Howe St & Rivermist.

- Schedule “B” will be the East side of Howe St.

What to Recycle

Old soda bottles and empty milk jugs are no longer just garbage. They must be recycled. A new state law took effect October 1, 2009 that prohibits all plastic bottles from being disposed of in landfills. For several years, the City of Southport has offered curbside recycling to all residences within our city limits.

The following items may be placed into your recycling bin:

- Aluminum and steel cans (clean)

- Newspapers, mixed papers, junk mail, magazines and paperboard (i.e. cereal boxes)

- Plastic containers #1 and #2 (jugs, bottles, tubs and jars). No single use items accepted.

- Corrugated cardboard (boxes must be broken down & flattened)

- Green, brown and clear glass containers (clean)

- Do not place items in plastic garbage bags or store bags.

- Do not put plastic store bags in recycle bins. Return bags to area stores for recycling.

Current City Tax Rate

$0.31 per $100 of

assessed property value**

Current year Southport City Taxes are collected by the Brunswick County Tax Collector. For questions about your current tax bill contact them at:

Brunswick County Tax Collection

Phone: 910.253.2729

Toll-Free: 800.222.0593

Email

Brunswick Co. Tax Records

Beginning July 1 2024, all registered vehicles in the Southport City Limits will have a $30 fee collected at time of annual registration renewal.

Audits

Annual Audit 2024-25

Annual Audit 2023-24

Annual Audit 2022-23

Annual Audit 2021-22

Annual Audit 2020-21

Annual Audit 2019-20

Annual Audit 2018-19

Annual Audit 2017-18

Annual Audit 2016-17

Annual Audit 2015-16

Annual Audit 2014-15

Annual Audit 2013-14

Annual Audit 2012-13

Annual Audit 2011-12

Annual Audit 2010-11

Annual Audit 2009-10

2023 Revaluation Information & FAQ

Q: What is a revaluation/reappraisal?

A: A revaluation, or reappraisal, is an updating of tax values to bring them back in line with the current sale price of properties. Brunswick County conducts a Reappraisal every four years. The last Reappraisal was effective January 1, 2019.

Q: When will the next revaluation/reappraisal take place?

A: The next County-wide reappraisal for Brunswick County is effective January 1, 2023. Brunswick County revaluation/reappraisals are completed in-house and should be completed in February 2023

Q: Is everyone getting a revaluation/reappraisal or just me?

A: The revaluation includes every parcel in Brunswick County.

Q: What is market value?

A: Market value is defined as “the price estimated in terms of money at which the property would change hands between a willing and financially able buyer and a willing seller, neither being under any compulsion to buy or to sell and both having reasonable knowledge of all the uses to which the property is adapted and for which it is capable of being used.”

Q: Is my property value going up?

A: Not necessarily, however, the majority of properties are selling for substantially above the 2019 revaluation/reappraisal rate.

Q: Is my tax bill going up?

A: When tax values go up, tax rates generally come down. If a revenue neutral tax rate is used, then the average property owner will pay about the same amount of taxes as they did before the revaluation.

Q: What is a Revenue Neutral Tax Rate?

A: This is the tax rate that would bring in the same tax dollars using the new values as the old rate would have using the old values. At revenue neutral, the increased values do not result in increased tax revenue. Brunswick County is required to publish the revenue neutral tax rate but is not required to adopt it. The City of Southport will adopt the tax rate no later than the end of June 2023. Do not estimate your current value based on the 2019 tax rate.

Q: What if I have questions about my new value?

A: You may be able to find the answer to your question by reviewing your tax record. Visit brunsco.net to locate your property record. If you still have questions, you may call Brunswick County Tax Office at (910) 253-2829, Monday through Friday from 8:30 a.m. – 5 p.m. and they’ll be happy to assist you.

Q: What if I disagree with my value?

A: You can submit an appeal to Brunswick County Tax Office. You may do this online, by mail, or in person. Call (910) 253-2829 for more details.

Q: What are valid reasons to appeal my value?

- Property value is significantly higher or lower than its actual fair market value as of January 1, 2023.

- Property value is inconsistent with the values of similar properties.

Q: What are invalid reasons to appeal my value?

- Percentage Increase or Decrease from the previous assessed value.

- Percentage Increase or Decrease as compared to any area’s average increase or decrease (county, region, area, neighborhood, etc.)

- Your financial ability to pay any anticipated tax. (Note: An increase or decrease in value does not mean you will pay more or fewer taxes.)

Q: Is this required?

A: Yes, property revaluation/reappraisal is a State-mandated task.

Q: Does my property have to be reappraised?

A: While North Carolina state law does not allow anyone to “opt out” of the property revaluation process, residents may qualify for relief. Among them are the Elderly or Disabled Homestead Exclusion, the Disabled Veteran Homestead Exclusion, and the Homestead Circuit Breaker. Also, properties presently used for agriculture, horticulture or farmland may qualify for relief. To find out more about tax relief, call the Brunswick County Tax Office at 910-253-2811, or email taxadmin@brunswickcountync.gov.

Q: Can I opt out?

A: No.

Q: Whom can I contact if I have more questions?

The Finance Department is responsible for all financial functions of the City. These functions include electric billing, accounts payable, accounting and financial reporting, delinquent tax bills, payroll, cash receipts, cash management, as well as numerous other functions.

Office Hours: Monday – Friday, 8:30 AM – 5:00 PM, (910) 457-7900

City Hall

Utility Department

1029 N. Howe Street, Southport, NC 28461

(910) 457-7900, Option 1

Email Utility Department

Joey Kronenwetter

Finance Director

Email

910-457-7900 ext. 1031

Jean Davidson

Deputy Finance Director/Tax Collector

Email

910-457-7900

Kelly Tooley

Revenue Specialist

Email

910-457-7900, option 1

Angie Bates

Accounts Payable

Email

910-457-7964

Let us know how we are doing: